| Pentax/Camera Marketplace |

| Pentax Items for Sale |

| Wanted Pentax Items |

| Pentax Deals |

| Deal Finder & Price Alerts |

| Price Watch Forum |

| My Marketplace Activity |

| List a New Item |

| Get seller access! |

| Pentax Stores |

| Pentax Retailer Map |

| Pentax Photos |

| Sample Photo Search |

| Recent Photo Mosaic |

| Today's Photos |

| Free Photo Storage |

| Member Photo Albums |

| User Photo Gallery |

| Exclusive Gallery |

| Photo Community |

| Photo Sharing Forum |

| Critique Forum |

| Official Photo Contests |

| World Pentax Day Gallery |

| World Pentax Day Photo Map |

| Pentax Resources |

| Articles and Tutorials |

| Member-Submitted Articles |

| Recommended Gear |

| Firmware Update Guide |

| Firmware Updates |

| Pentax News |

| Pentax Lens Databases |

| Pentax Lens Reviews |

| Pentax Lens Search |

| Third-Party Lens Reviews |

| Lens Compatibility |

| Pentax Serial Number Database |

| In-Depth Reviews |

| SLR Lens Forum |

| Sample Photo Archive |

| Forum Discussions |

| New Posts |

| Today's Threads |

| Photo Threads |

| Recent Photo Mosaic |

| Recent Updates |

| Today's Photos |

| Quick Searches |

| Unanswered Threads |

| Recently Liked Posts |

| Forum RSS Feed |

| Go to Page... |

PentaxForums.com → Off-Topic Forums → General Talk

→

Who are these people who continually have been wrong, and never right, for 70+ years?

|

| Search this Thread |

| 05-13-2011, 01:22 PM | #16 |

| | |

| 05-13-2011, 01:54 PM | #17 |

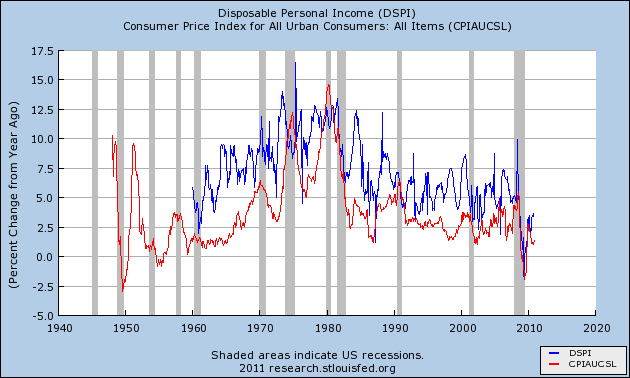

| OK but give me a name of a specific creationist and I bet you will find a rebuttal by a biologist or some such authority......... ON the far extreme: So you relate Mr. Mitchell to the tin foil hat people who are not worthy of debate???  There is no modern relationship between deficits and inflation Popular faith holds that increasing the money supply causes inflation. History shows that is not correct. As you can see in the above graph, there is no relationship between changes in federal debt/money, shown in blue, and a loss in value of money (inflation), shown in red. The value of money is determined by supply and demand. So, it is true that increasing the money supply without interest rate control would lead to inflation, unless the demand also was increased. What increases demand? An increase in interest rates. Demand is based on risk and reward, and the reward for owning money is interest. The higher our interest rates, the greater the demand for our debt/money. In short, deficit spending will not cause inflation if we increase interest rates, thereby increasing the demand for money. We have the power to prevent inflation. For those who want a balanced budget, here is a history lesson: 1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819. 1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837. 1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857. 1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873. 1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893. 1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929. 1998-2001: U. S. Federal Debt reduced 9%. Recession began 2001 Maybe if you bothered to read him a bit......more..... | |

| 05-13-2011, 02:03 PM | #18 |

| Guest Post: Modern Monetary Theory ? A Primer on the Operational Realities of the Monetary System naked capitalism While there is over 20 years of MMT literature published in books, refereed journals, and in working papers available all over cyberspace (though most can be found at CFEPS, CofFEE, the Levy Institute, and MoslerEconomics) it’s only recently that we began blogging, and it is clear that many commenters on MMT-related posts are largely unaware that this extensive literature exists and serves as the basis for our blogposts that are by necessity less detailed. Indeed, over the past 10-15 years, I have personally waded through all of the publications from various official sources on the (relevant-to-MMT aspects of the) monetary system’s functioning that I could get my hands on and have found nothing that is inconsistent with how MMT describes it. We have had numerous conversations with individuals responsible for Fed operations, Treasury operations, and relevant parts of the financial system, and cannot recall any significant disagreements there, as well. It is interesting to note that an increasing number of neoclassical economists are publishing research describing the monetary system in a manner consistent with MMT (without appropriate attribution, usually), though these descriptions have yet to make their way into neoclassical models of the macroeconomy. Fun little exchange....... Rodger Malcolm Mitchell says: August 30, 2010 at 4:28 pm Federal debt poses no current financial risk, simply because financial risk involves but two factors: 1. Ability and desire to repay 2. Inflation The federal government owes money it has the unlimited ability to create. No federal check or T-security ever has bounced. So, #1 is not a realistic factor Since 1971, the federal debt has increased 1600% without inflation beyond what the government has targeted. During that time, there has been no relationship between federal debts and inflation. There has, however, been a close correlation between oil prices and inflation. See: INFLATION. Today, with the largest deficits in modern history, we are far more concerned about deflation than inflation. And with good reason. Deflation is a far more serious problem. Rodger Malcolm Mitchell Bates says: August 30, 2010 at 10:29 pm “The federal government owes money it has the unlimited ability to create. No federal check or T-security ever has bounced. So, #1 is not a realistic factor” More baloney! The Fed Gov will have one failed treasury auction and it’s game, set, match. When the interest on US Debt becomes so large that the entire US GDP is required to pay them do you think that this house of cards will continue? You are truly delusional. stf says: August 30, 2010 at 11:43 pm Sorry, Bates, but the US has already had failed auctions in the past, and looks like we’re all still here. See Garbade’s research publications on the history of Treasuries at the NYFed. | |

| 05-13-2011, 02:28 PM | #19 |

| FACTS.. or what???? For those who want a balanced budget, here is a history lesson: 1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819. 1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837. 1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857. 1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873. 1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893. 1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929. 1998-2001: U. S. Federal Debt reduced 9%. Recession began 2001 These MMT advocates make about as much sense as astrologers or televangelists they might make some interesting observations but fail to deliver when it comes to making rock solid cases. This example goes back to the amazon commenter's statement that this guy has no understanding of the federal reserve system and confusing (or misleading might be more accurate) corralation with causality. What role does monetary policy have in this scenario? As you know, the Federal Reserve has a dual mandate, which requires the central bank to try to achieve both maximum sustainable employment and price stability. The "no modern relationship" is not because of MMT or anything of that sort. Its because you have some clever bastards tinkering with monetary policy. Its like saying that the volume of water coming down the Mississippi river has no modern relationship on flooding in new orleans. Its not because New Orleans has magically become flood proof or the laws of hydraulics have changed in the past 80 years, its because there are some clever bastards tinkering with spillways and levees. Also its important to point out that his graph has carefully picked the measure of inflation which leaves out commodities, CPI EXCLUDING Food and Energy. That measure is more closely tied with manufactured goods where the sellers can modify something about their product or lower their accepted profit margin to cope with a tough economy by keeping the price the same. What else does he have? It only takes a little grey matter and 10 minutes to see the glaring fallacies in these weak ideas. | |

| 05-13-2011, 02:34 PM | #20 |

| 05-13-2011, 02:44 PM | #21 |

|

Looks like it wore her out.

| |

| 05-13-2011, 03:16 PM | #22 |

| Veteran Member      | On the other extreme, if we suddenly created 100 dollars for every dollar out there now with the flick of a switch, I have some trouble believing that persons outside our system wouldn't view those dollars as being worth closer to one cent, and we will either need to cut back on imports or suffer inflation. As we make less and less that other countries want, I think that threshold goes down. Zimbabwe's 100-Trillion-Dollar Bill Is a Hot Collectible - WSJ.com |

| 05-13-2011, 03:58 PM | #23 |

| Those are facts but there is no proof that A caused B only that A happened before B. The supermoon happened right before the Japanese earthquake does that mean that it caused it like some kooky astrologer claimed? Katrina happened right before decadence festival does that mean god smote us for being gay friendly like some kooky televangelist claimed? These MMT advocates make about as much sense as astrologers or televangelists they might make some interesting observations but fail to deliver when it comes to making rock solid cases. This example goes back to the amazon commenter's statement that this guy has no understanding of the federal reserve system and confusing (or misleading might be more accurate) corralation with causality. Ben Bernanke The "no modern relationship" is not because of MMT or anything of that sort. Its because you have some clever bastards tinkering with monetary policy. Its like saying that the volume of water coming down the Mississippi river has no modern relationship on flooding in new orleans. Its not because New Orleans has magically become flood proof or the laws of hydraulics have changed in the past 80 years, its because there are some clever bastards tinkering with spillways and levees. Also its important to point out that his graph has carefully picked the measure of inflation which leaves out commodities, CPI EXCLUDING Food and Energy. That measure is more closely tied with manufactured goods where the sellers can modify something about their product or lower their accepted profit margin to cope with a tough economy by keeping the price the same. What else does he have? It only takes a little grey matter and 10 minutes to see the glaring fallacies in these weak ideas. Your treating your beliefs as religion.. Mises and most economists have been WOEFULLY inaccurate in anything AND always add the qualifiers like "extraordinary" "inexplicable circumstances" ect.. I walked into this stuff w/ a completely unbiased and even prejudiced against (ie taxing rich more) but I have one thing you don't seem to possess.... The simpler the explanation the more likely it's correct..  These people aren't some trailer trash discussing this nor is there not a historical record.. 4 YEARS ago......... Perils of inflation targeting | vox - Research-based policy analysis and commentary from leading economists http://www-ceel.economia.unitn.it/staff/leijonhufvud/publweb10.pdf | |

| 05-13-2011, 04:53 PM | #24 |

|

A LITTLE more............ This equation underpins the MMTers' disdain for the tea party's call for fiscal austerity. We derived the above equation through accounting tautologies, not by relying on any particular economic theory, so it should be impregnable. And gosh it sure looks like if the government were to reduce its budget deficit, then the private sector's saving would necessarily go down. Yikes! Have the Austrians been unwittingly advocating massive capital destruction without realizing it? Of course then he babbles about coconuts.. Then the real babble.. Becomes "inference" without fact Of course, the Keynesians and MMTers would have a different spin on the result of higher government spending in our current economic environment, but that's not really the issue here. My point is that the national-income accounting tautologies aren't a good critique of the tea party after all. Those equations are just as consistent with economic theories claiming that government spending cuts will lead to faster economic growth. The fans of MMT should therefore stop pointing to those identities as if they prove the futility of government austerity during an economic downturn. Those tautologies, and the cherished equations of the three sectors, are consistent with post-Keynesian and tea party economics. Even gets insulting and condescending as the mind closes...  MMT Bask AND back to coconuts...........  http://seekingalpha.com/article/269408-final-thoughts-on-the-austrians-take-...onetary-theory In a modern banking system, banks are never reserve-constrained. An Austrian colleague of Mr. Murphy’s has shown this to be true. So, the entire point on crowding out is dead in the water. There are components of the Austrian school that are compatible with MMT and I think the Austrian school makes some fine contributions to the field of economics. Attempting to discredit MMT through mythical worlds and highly flawed beliefs with regards to banking operations are not amongst them. Note: This article is nothing personal against Mr. Murphy. I am sure he’s a good man and a fine American. His teachings represent a broader perspective by a wide audience. So while some of these arguments may appear directed at him, I can assure you they are not. They are merely meant to show how a broader school of thinking is, in my opinion, misguided and/or incomplete. http://pragcap.com/why-credit-deflation-is-more-likely-than-mass-inflation-a...an-perspective THEN you get back to this..  http://pragcap.com/where-is-inflation-headed Then here... http://forums.wallstreetexaminer.com/topic/933817-cullen-roche-says-that-i-d...fund-spending/ and becomes personal again ...  Based on this: http://pragcap.com/n-y-fed-explains-government-spends-issues-bonds This is a point you often (erroneously) make about MMT. I don’t think any of us would argue that you can have an economy that does not have productivity and real output. The value of the currency is ultimately representative of the goods and services that the economy outputs. That is a given in my opinion. MMT does not explain the growth and productivity of the nation. It merely explains the framework within which the currency unit is used, maintained, created and destroyed. If the govt using the currency unit is corrupt, stupid and misguided the system will fail. That is not a failing of MMT. It is a failing of govt. Take your time...........  Love this part: This doesn’t mean auctions can’t fail. They can. But quite honestly, it wouldn’t matter all that much as the reserve drain would simply take place at a later date. The auctions are designed to succeed because they are merely targeting reserves that they KNOW are in the system. There is no red phone at Treasury that Tim Geithner uses to call China before it spends money. No red phone to Japan. There is only a phone to the Fed where reserve forecasters communicate with the Treasury and the Primary Dealers to determine the size of the necessary auctions. The reserve drain is thus accomplished, Congress thinks we have “funded” our spending and we can all go along our merry way. Why does any of this matter you ask? Because once you realize that foreigners do not fund our spending you begin to realize that everything your textbook taught you about our monetary system is simply not true. A government with a monopoly supply of currency in a floating exchange rate system has no solvency risk unlike a nation such as Greece which exists in a single currency system with what is essentially a foreign central bank. The policy implications in such a system are astronomically different – particularly for a nation suffering a balance sheet recession.  The ratio matters, but not nearly as much as people think. Some say a strong ratio is 2.5:1. Well, all they really need is a 1:1 ratio so as long as they achieve their reserve drain who cares what the ratio is? Santelli should grade every single auction over 1:1 as an A+ because I know that’s the grade the US govt gives it. In other words, mission accomplished so long as they achieve full reserve drain. Last edited by jeffkrol; 05-13-2011 at 06:09 PM. | |

| 05-13-2011, 08:36 PM | #25 |

|

OK Mike, had to help you out..you have a valid point causality is not always linked to recorded observations. A basic tenant of science... Do Balanced Budgets Cause Depressions? - A Response Here is an earlier analysis and an analysis of that.. Lets start w/ what I mean.. Here the author basically states 5 out of the 6 periods had increased debt followed by a payoff. 1 was an "outlier"...A completely voluntary pay down of debt.. Hence, only one of the periods represented a seemingly voluntary paydown of debt not recently acquired through war. 1)paying off fed debt causes recession 2)increasing fed debt THEN paying it off creates a recession 3)war debt (with exceptions) causes recessions..after you start to pay them off Hmmmm.... what is one to think??? How about DON'T pay down the debt......... win,win,win...    anyways EXCEPTIONS are always bothersome and lead me to believe the "hypothesis" is NOT correct, not matter the number of supporting points (especially w/ a small set) I pretty sure contraction of fed spending will cause problems with the state of the current economy.............just GOT TO LEARN what to spend it on... | |

| 05-13-2011, 09:31 PM | #26 |

| In 1996, Mitchell wrote the book, THE ULTIMATE AMERICA, which he later republished under the title, FREE MONEY, PLAN FOR PROSPERITY. The books were based on three facts: 1. A growing economy requires a growing supply of money. 2. All money is a form of debt. 3. The Federal Government has the unlimited ability to create money. These three fundamental truths, and subsequent research, led to Mr. Mitchell's assertion that federal taxes could and should be eliminated. Further discussion can be found on Mr. Mitchell's web site but... And as long as the government is able to collect taxes, the public will have to accept the currency. This is exactly the “tax-driven money” idea which is the basis of Chartalism and MMT. Taxes are what creates demand for the otherwise useless currency. This is still one of my biggest hang-ups with MMT/chartalism the idea that fiat has a money that is derived from anything less than trust that the monetary policy is sound and the government can be trusted not to inflate it too fast. To me, the almost worthless money becomes worthless when you remove that trust and derive its value from the ability to use it for tax payments then when you eliminate taxes as Mr Mitchell would like to do it becomes less than worthless, only suitable for bathroom tissue and heating fuel. I for one would demand my own compensation be set in something other than the dollar and would hold my savings and investments in non-dollar denominated accounts and assets if this system was ever adopted as US monetary policy. MMT does not explain the growth and productivity of the nation. It merely explains the framework within which the currency unit is used, maintained, created and destroyed. If the govt using the currency unit is corrupt, stupid and misguided the system will fail. That is not a failing of MMT. It is a failing of govt. The easier it is for them to print money the more dangerous their corruption and stupidity is to the rest of us. | |

| 05-13-2011, 10:17 PM | #27 |

| Wallstreet is. After all they tell 'em what to do and they own the banks. Didn't used to be that way and the countries monetary policy was in much better shape. Did ever think that they should be separated again? | |

| 05-14-2011, 05:19 AM | #28 |

| -Mr. Mitchell's autobiography from link in OP but... https://www.pentaxforums.com/forums/political-religious-discussion/129341-mod...ml#post1348241 This is still one of my biggest hang-ups with MMT/chartalism the idea that fiat has a money that is derived from anything less than trust that the monetary policy is sound and the government can be trusted not to inflate it too fast. To me, the almost worthless money becomes worthless when you remove that trust and derive its value from the ability to use it for tax payments then when you eliminate taxes as Mr Mitchell would like to do it becomes less than worthless, only suitable for bathroom tissue and heating fuel. I for one would demand my own compensation be set in something other than the dollar and would hold my savings and investments in non-dollar denominated accounts and assets if this system was ever adopted as US monetary policy. This is correct, our government is in control of our monetary policy and if the policy fails its because our government is corrupt, stupid, and misguided... Even if we don't all agree on which ones are the most corrupt, stupidest, and most misguided, the only thing there is universal agreement on is that a huge majority of our government officials are corrupt, stupid, and misguided. The easier it is for them to print money the more dangerous their corruption and stupidity is to the rest of us. to discuss where BEST to spend, not don't spend anything, just cut is "Adult" in the eyes of the "deficits don't matter crowd" To be honest I think Obama "gets it".......... the "losing" on the bush cuts was a "win" in MMT terms... Isn't it about time we let REALITY be REALITY and not perception be reality??? The reason the World has faith in our currency is not based on the currency but the latent economic power in our country..Labor, resources, determination, our ability to suffer needlessly  .. .."GLOOM and DOOM" economic prophecy based on fiction will be self fulfilling AND that is SAD. We are CHOOSING to lag rather then lead based on false assumptions. What we have to do and CAN do is reign in the monopolistic Oligarchs who are trying to be the "world gov". we are turning our backs on or at least, at best, tagging along. (sounds scarier then it's meant to be) WE live in the real world and we should leave Perception economics" to Wall Street game players but we must set up a barrier where they can't impact our world too heavily.. fun w/ balance sheet recessions (As I stated the "crazy " idea of the FED paying off owner occupied houses in default rather then paying the banks makes MORE sense financially then anything the FED has done, unfortunately "we" are still "I" motivated) Consumers have recognized that they have an unsustainable problem. For now, de-leveraging continues to be the right path for the US economy (despite the Fed’s wishes of re-leveraging). As I’ve previously discussed, this balance sheet recession is likely to continue well into 2013, assuming that de-leveraging actually continues. If consumers re-leverage this will only add to the unsustainable environment that surfaced during the housing bubble. This all means the economy remains incredibly unstable. These levels of leverage are simply not sustainable and still pose the largest risk to the economy. For now, deficit spending is offsetting the impact of the de-leveraging and is helping to sustain marginal economic recovery. http://www.adamsmithesq.com/archives/2009/04/the-balance-sheet-recessi.html If this is a "balance sheet recession," be grateful at least that, while no firm you work for and no industry you work in can bulletproof your 401(k) or the "mark to market" value of your home, the long-term prospects for your income are, I maintain, as bright or brighter than ever. Chin up. Last edited by jeffkrol; 05-14-2011 at 05:36 AM. | |

| 05-15-2011, 12:54 AM | #29 |

|

_________________ On the other hand, if the world wakes up tomorrow and decides they aren't taking any more American dollars.. there won't be a thing the US can do about it. What do Iraq, Iran and Libya all have in common? Oil and the fact that they were/are doing their best to accept as payment for their oil something of value, that is, something other than US fiat currency. Gaddafi was going to start accepting only gold. That is why NATO is attacking Libya, not for any "pro-democracy" propaganda we've all been fed. ___ | |

| 05-16-2011, 06:29 AM | #30 |

|

| Bookmarks |

| Tags - Make this thread easier to find by adding keywords to it! |

bomb, debt, inflation, mitchell, money, people, term, time  |

Similar Threads

Similar Threads | ||||

| Thread | Thread Starter | Forum | Replies | Last Post |

| either work for rich people or we sell stuff to rich people | Nesster | General Talk | 12 | 04-02-2011 11:18 AM |

| 42 years | Circle of Confusion | Welcomes and Introductions | 4 | 04-22-2010 09:45 AM |

| What's wrong with some of you people? | larryinlc | General Talk | 43 | 11-19-2009 09:20 AM |

| 32 years | graphicgr8s | General Talk | 35 | 08-17-2009 03:34 PM |

| 95 years apart | ismaelg | Post Your Photos! | 7 | 07-07-2009 06:29 PM |