| Pentax/Camera Marketplace |

| Pentax Items for Sale |

| Wanted Pentax Items |

| Pentax Deals |

| Deal Finder & Price Alerts |

| Price Watch Forum |

| My Marketplace Activity |

| List a New Item |

| Get seller access! |

| Pentax Stores |

| Pentax Retailer Map |

| Pentax Photos |

| Sample Photo Search |

| Recent Photo Mosaic |

| Today's Photos |

| Free Photo Storage |

| Member Photo Albums |

| User Photo Gallery |

| Exclusive Gallery |

| Photo Community |

| Photo Sharing Forum |

| Critique Forum |

| Official Photo Contests |

| World Pentax Day Gallery |

| World Pentax Day Photo Map |

| Pentax Resources |

| Articles and Tutorials |

| Member-Submitted Articles |

| Recommended Gear |

| Firmware Update Guide |

| Firmware Updates |

| Pentax News |

| Pentax Lens Databases |

| Pentax Lens Reviews |

| Pentax Lens Search |

| Third-Party Lens Reviews |

| Lens Compatibility |

| Pentax Serial Number Database |

| In-Depth Reviews |

| SLR Lens Forum |

| Sample Photo Archive |

| Forum Discussions |

| New Posts |

| Today's Threads |

| Photo Threads |

| Recent Photo Mosaic |

| Recent Updates |

| Today's Photos |

| Quick Searches |

| Unanswered Threads |

| Recently Liked Posts |

| Forum RSS Feed |

| Go to Page... |

|

| 2 Likes | Search this Thread |

| 07-28-2011, 07:51 AM | #46 |

| You mean the Economic crisis brought about through right wing republican stewardship  My outsider point of view is generally as a country you need to raise your tax rate particularly at the higher end of the income scale and use that to pay down debt. the idea that lower taxes creates jobs is the biggest fallacy that has been sold lock stock and barrel to the American people, who in a fit of narcissism bought it. Your debt is sitting at about 47K per person and yet there is still the believe that by lowering taxes you will generate more revenue through job creation and it will get paid down.  Apparently 20 years of this still hasn't proved the theory wrong. Our system in Canada isn't perfect but our debt has been reduced rather than increased (mostly under the liberals who ran a pretty fiscally responsible program for quite a while) Our debt now sits at a still to high 16K per person Historically we were much closer per capita on the deficit and it's really the last 20 years that have seen the huge gap. I hate to have to point it out but if you don't start raising taxes at some point you will go bankrupt, slashing all your (very limited in any case)services won't make 17 trillion go away I'll just go duck for cover (and BTW Gen this was not aimed at anything you said) | |

| 07-28-2011, 08:15 AM | #47 |

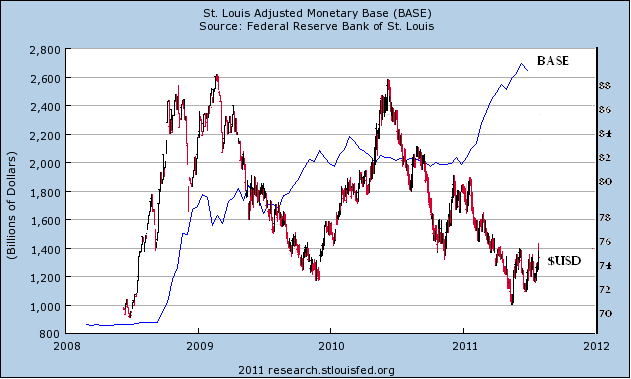

| judging anything coming out of China is questiuonable to begin with but lets start with the fact that they just continue to pour any surplus back in to subsidize private industry. n the first half of the year, China's exports rose 24% to $874.3 billion and imports grew 28% to $829.4 billion, resulting in a $44.9 billion trade surplus, down 18.2% from the same period a year earlier. China's fixed-asset investment in non-rural areas, a closely watched indicator of construction activity, is likely to increase 25% this year, the State Information Center added. China's non-rural FAI totalled CNY12.46 trillion ($1.93 trillion) between January and June, up 25.6% from a year earlier. My gut feeling is if you cut Chinese industry off the gov. teat they wouldn't be profitable.. Close to slave labor helps of course... China 2011 Trade Surplus Likely To Fall 14% To $157B - Think Tank - WSJ.com ON INFLATION.. note what I said earlier.. nothing to do w/ monetary policy or laber per se. Over the last year, China's inflation rate has more than doubled with food items accounting for nearly three-fourths of this increase. A large part of the food-linked inflation can be traced to a series of natural disasters in 2010, including droughts in the southwest and flooding in Hainan that disrupted the supply of fruits and vegetables. he evidence, however, does not necessarily support this assertion. First, export prices for other Asian economies - for example, South Korea, Malaysia and Taiwan - have also shown similar increases. This suggests that the rise is being driven more by a pass-through of rising global commodity prices, including oil and cotton, than by country-specific cost pressures. Indeed, a similar pattern was witnessed during the oil price boom of 2007-2008. Second, despite some labor market tightening, China still has a surplus of workers, with significant underemployment in some sectors.Overall, wage increases have not run too far ahead of productivity gains in recent years and corporate profit margins remain intact.  THE DOLLAR DEBASEMENT MYTH & THE FED’S BALANCE SHEET | PRAGMATIC CAPITALISM Last edited by jeffkrol; 07-28-2011 at 09:10 AM. | |

| 07-28-2011, 08:17 AM | #48 |

| My outsider point of view is generally as a country you need to raise your tax rate particularly at the higher end of the income scale and use that to pay down debt. the idea that lower taxes creates jobs is the biggest fallacy that has been sold lock stock and barrel to the American people, who in a fit of narcissism bought it. I don't know how generous canada is with deductions but I know some of the big ones like deductibility of mortgage interest is not around. What are the income tax rates in Canada? I don't view the low tax rates as a problem, what doesn't get explained well is that there is that setting tax policy is a balancing act between rates and compliance. If you set the rate too high, especially on wealthy people, they will be more aggressive in finding ways to hide their income as the cost-benefit of doing so increases. Same thing with the lower end of the income scale where the higher the taxes the more likely they are to work for cash under the table. The counterintuitive result of this is that with higher compliance a lower tax rate equals increased total tax collection. Its kind of like walmarts approach that if you only need a 1/2 liter jar of pickles but that jar costs $2 and the 4 liter jar of pickles costs $3 you will go for the big jar even though you don't really need or want it. | |

| 07-28-2011, 08:29 AM | #49 |

|

At least according to Wikipedia, Canadians pay a slightly higher percentage of GDP in taxes than the U.S. Half the country pays no FIT but pays plenty of other tax. They pay no FIT because they have little money and no wealth. Wealth inequality is much lower in Canada, and the GINI has been falling drastically as ours has been climbing. I would bet that a greater percentage of Canadians pay income taxes. I would like to see the evidence that tax avoidance is lower as the taxes are lower--at least at this range. I know of few wealthy people who think they are undertaxed even as their taxes are lower and lower. | |

| 07-28-2011, 08:38 AM | #50 |

|

Bloomberg/Businessweek chimes in: Why the Debt Crisis Is Even Worse Than You Think - BusinessWeek There is a comforting story about the debt ceiling that goes like this: Back in the 1990s, the U.S. was shrinking its national debt at a rapid pace. Serious people actually worried about dislocations from having too little government debt. If it hadn’t been for two wars, the tax cuts of 2001 and 2003, the housing meltdown, and the subsequent financial crisis and recession, the nation’s finances would be in fine condition today. And the only obstacle to getting there again, this narrative goes, is political dysfunction in Washington. If the Republicans and Democrats would just split their differences on spending and taxes and raise the debt ceiling, we could all get back to our real lives. Problem solved. Except it’s not that way at all. For all our obsessing about it, the national debt is a singularly bad way of measuring the nation’s financial condition. It includes only a small portion of the nation’s total liabilities. And it’s focused on the past. An honest assessment of the country’s projected revenue and expenses over the next generation would show a reality different from the apocalyptic visions conjured by both Democrats and Republicans during the debt-ceiling debate. It would be much worse. That’s why the posturing about whether and how Congress should increase the debt ceiling by Aug. 2 has been a hollow exercise. Failure to increase the borrowing limit would harm American prestige and the global financial system. But that’s nothing compared with the real threats to the U.S.’s long-term economic health, which will begin to strike with full force toward the end of this decade: Sharply rising per-capita health-care spending, coupled with the graying of the populace; a generation of workers turning into an outsize generation of beneficiaries. Hoover Institution Senior Fellow Michael J. Boskin, who was President George H.W. Bush’s chief economic adviser, says: “The word ‘unsustainable’ doesn’t convey the problem enough, in my opinion.” Even the $4 trillion “grand bargain” on debt reduction hammered out by President Barack Obama and House Speaker John Boehner (R-Ohio)—a deal that collapsed nearly as quickly as it came together—would not have gotten the U.S. where it needs to be. A June analysis by the Congressional Budget Office concluded that keeping the U.S.’s ratio of debt to gross domestic product at current levels until the year 2085 (to avoid scaring off investors) would require spending cuts, tax hikes, or a combination of both equal to 8.3 percent of GDP each year for the next 75 years, vs. the most likely (i.e. “alternative”) scenario. That translates to $15 trillion over the next decade—or more than three times what Obama and Boehner were considering. The language we use is part of the problem. Every would-be budget balancer in Washington should read “On the General Relativity of Fiscal Language,” a brilliant 2006 paper by economists Laurence J. Kotlikoff of Boston University and Jerry Green of Harvard University (available online from the National Bureau of Economic Research). The authors write that accountants and economists have something to learn from Albert Einstein’s theory of relativity, about how measured quantities depend on one’s frame of reference. Terms such as “deficit” and “tax,” they write, “represent numbers in search of concepts that provide the illusion of meaning where none exists.” A more revealing calculation is the CBO’s measurement of what’s called the fiscal gap. That figure is conceptually cleaner than the national debt—and consequently more alarming. Boston University’s Kotlikoff has extended the agency’s analysis from 2085 out to the infinite horizon, which he says is the only method that’s invulnerable to the frame-of-reference problem. It’s an approach used by actuaries to make sure that a pension system doesn’t contain an instability that will manifest itself just past the last year studied. Years far in the future carry very little weight, converging toward zero, because they are discounted by the time value of money. Even so, Kotlikoff concluded that the fiscal gap—i.e., the net present value of all future expenses minus all future revenue—amounts to $211 trillion. ... Which means we’ve been heading the wrong way for years. Even in the late 1990s, when official Washington was jubilant because the national debt briefly shrank, fiscal-gap calculations showed that the government was quietly getting into deeper trouble. It was paying out generous benefits to the elderly while incurring big obligations to boomers, whose leading edge was then 15 years from retirement. Now the gray deluge is upon us. As Holtz-Eakin, now president of the American Action Forum, a self-described center-right policy institute, says: “We’re just in a world of hurt.” The U.S. is in danger of reaching a generational tipping point at which older Americans have the clout to vote themselves benefits that sap the strength of the younger generation—benefits that can never be repeated. Kotlikoff argues that we may have reached that point already. He worries that the U.S. could become Argentina, which went from one of the world’s richest to lower-middle income in a century of chronic mismanagement. Senior citizens are being told by their own lobbyists, repeatedly, that any attempt to rein in the cost of Social Security and Medicare is an unjust attack on earned benefits. “Stop the liberals from raiding the Social Security Trust Fund once and for all!” says a recent mailing from the National Retirement Security Task Force. Similar messages aimed at Democratic voters make the same charge against Republicans. No wonder Obama and Boehner were rebuffed by their own parties for putting entitlements on the table. In the end neither the House nor the Senate debt-ceiling proposals touched Social Security or Medicare. Not pretty. ... Republicans in Congress, not wanting to appear to defend the rich, have attempted to block any deal that includes higher taxes on the grounds that tax hikes are “job-killing.” But experience shows that in a period of slack demand like the present, tax hikes are no more job-killing than spending cuts, and probably less so. Cutting spending—say, by firing federal employees or canceling procurement—removes demand from the economy dollar-for-dollar. A dollar tax hike, on the other hand, especially one aimed at upper incomes, cuts demand by less than a dollar. Those who pay the tax cover part of it from their savings and only part by reducing their spending. If lawmakers insist on using the phrase “job-killing,” Roberton Williams, a senior fellow at the Brookings Institution-Urban Institute Tax Policy Center, wrote in a recent blog post, “they should apply it equally to both tax increases and spending cuts.” | |

|

| Bookmarks |

| Tags - Make this thread easier to find by adding keywords to it! |

chris, debt, default, defaults, dollar, dollars, gold, time, u.s, war  |

| Top Liked Posts |

2  Post #3 by Ratmagiclady Post #3 by Ratmagiclady |

Similar Threads

Similar Threads | ||||

| Thread | Thread Starter | Forum | Replies | Last Post |

| Auto ISO with ext flash defaults to high? | wutsurstyle | Pentax K-5 & K-5 II | 14 | 07-29-2011 11:41 AM |

| AE-L and defaults | OK5 | Troubleshooting and Beginner Help | 4 | 04-06-2011 06:17 AM |

| 2 cameras, which lenses as defaults? | audiobomber | Pentax SLR Lens Discussion | 15 | 03-04-2010 08:14 AM |

| Nature Natural History | Rense | Post Your Photos! | 8 | 02-06-2010 04:38 AM |

| Misc remembering history....... | dcmsox2004 | Post Your Photos! | 3 | 11-22-2009 04:33 PM |