| Pentax/Camera Marketplace |

| Pentax Items for Sale |

| Wanted Pentax Items |

| Pentax Deals |

| Deal Finder & Price Alerts |

| Price Watch Forum |

| My Marketplace Activity |

| List a New Item |

| Get seller access! |

| Pentax Stores |

| Pentax Retailer Map |

| Pentax Photos |

| Sample Photo Search |

| Recent Photo Mosaic |

| Today's Photos |

| Free Photo Storage |

| Member Photo Albums |

| User Photo Gallery |

| Exclusive Gallery |

| Photo Community |

| Photo Sharing Forum |

| Critique Forum |

| Official Photo Contests |

| World Pentax Day Gallery |

| World Pentax Day Photo Map |

| Pentax Resources |

| Articles and Tutorials |

| Member-Submitted Articles |

| Recommended Gear |

| Firmware Update Guide |

| Firmware Updates |

| Pentax News |

| Pentax Lens Databases |

| Pentax Lens Reviews |

| Pentax Lens Search |

| Third-Party Lens Reviews |

| Lens Compatibility |

| Pentax Serial Number Database |

| In-Depth Reviews |

| SLR Lens Forum |

| Sample Photo Archive |

| Forum Discussions |

| New Posts |

| Today's Threads |

| Photo Threads |

| Recent Photo Mosaic |

| Recent Updates |

| Today's Photos |

| Quick Searches |

| Unanswered Threads |

| Recently Liked Posts |

| Forum RSS Feed |

| Go to Page... |

PentaxForums.com → Off-Topic Forums → General Talk

→

Corporate profits are highest-ever share of GDP

|

| Search this Thread |

| 12-09-2012, 07:32 AM | #16 |

| From the things that I have heard, we have a problem with uncertainty (which your post appears to agree with). At this moment the government has to make some spending cuts and/or revenue increases to keep the national debt from ballooning to 200% of GDP. There are many companies who gain a portion of their revenue form government contracts who would like to know whether their particular contracts will still be effected. If they are, these companies may have to make adjustments. If their particular contracts are not effected, and they are certain they will not be effected in the near future, they may be able to decrease the amount cash reserves they are holding and invest their cash in new business ventures. I actually think that the contents of the spending cuts and/or tax increases matter less than the increase in certainty that would occur if the president and congress come together and make a decision. | |

| 12-09-2012, 08:46 AM | #17 |

| U.K. sticks with austerity as economy weakens - Dec. 5, 2012 The increasingly dour outlook for the British economy may hold a lesson for the United States. The British case has prompted observers to speculate what may happen to the American economy if lawmakers implement similar austerity measures to tackle the deficit quickly. Many economists and Federal Reserve Chairman Ben Bernanke have instead said officials need to get the economy on a long-term sustainable path without cutting too much in the short term and putting the economy back in a ditch. The British experience “is definitely a cautionary tale,” said John Doyle, director of markets at Tempus Consulting in Washington. “We definitely have something to learn: some spending cuts are necessary, but to what extent — that’s where they have to be careful.” “The bond market hasn’t punished us — yet,” he noted, the way it has punished Spain and Italy, by pushing yield up. Attention on the U.K. economy and its comparison to the U.S. followed Chancellor of the Exchequer George Osborne’s autumn statement Wednesday. He said the U.K. economy will shrink 0.1% in 2012, down from a previous forecast of 0.8% growth. He also ordered a squeeze on welfare benefits, as the budget deficit looked set to be higher than expected, according to media reports. Osborne said spending cuts and tax increases needed to stabilize and then reduce government debt will continue until 2018, three years later than he had initially planned, according to The Wall Street Journal. Read: U.K.’s Osborne’s says austerity to continue until 2018. Comparison between the U.K. and U.S. makes ‘a strong case for more pro-growth policies over front-loaded austerity. So far, both President Barack Obama and House Republicans have publicly dug in on their positions, especially on middle-class tax rates. Read: Obama spurns Republican fall-back plan. Strong case for gridlock? Plenty of analysts have been watching the impact of Britain’s austerity measures on markets since they started, saying that experience could provide a roadmap for the U.S. Read previous story: What U.S. budget cuts may mean for markets. “By a diverse set of metrics, it is remarkable how poorly the U.K. economy is performing relative to the U.S. in the post-financial-crisis world,” said Alan Ruskin, a macro strategist at Deutsche Bank. The U.K. economy has shrunk 3.1% since the end of 2007, he wrote in a report. Over the same period, the U.S. economy has grown 2.3%. When super-wealthy conservatives like private-equity investor Peter Peterson and Goldman Sachs chief executive Lloyd Blankfein lobby Washington to cut benefits in Social Security and Medicare while keeping their own taxes low just when progressives feel empowered by a national election, the chances of unintended consequences are much higher. Take the “Fix the Debt” conference in Washington this week, one of many events benefiting from Peterson’s deep pockets designed to bring “bipartisan” pressure on Congress on fiscal issues (though as one critic joked, bipartisan in this context means the 1% from both parties............... As with President Barack Obama’s determination in the wake of the election to see taxes go up on high incomes and to avoid a new debt-ceiling standoff, these not-so-coded statements from one of his top advisers shows a new progressive backbone in a debate that has been dominated by deficit scolds pursuing an agenda of lower taxes for the rich. Anybody who is missing the new confidence in statements by progressives like Vermont Sen. Bernie Sanders or Washington Sen. Patty Murray isn’t paying attention. At a briefing in the National Press Club on Wednesday, Sanders, who is an independent but caucuses with the Democrats, called on his fellow lawmakers to reject all cuts to social network programs, a theme he has been hammering since the election. “What we are engaged in here is not a great debate about how we can manage to go forward on reducing the deficit,” Sanders said, noting there were several ways that could be achieved. “What is taking place is a political debate,” he continued, on whether to keep taxes low or cut social programs. Read Sanders says fiscal cliff is really about financial inequality.). As most Americans sit sipping their Kool-Ade and blaming their neighbors......... Last edited by jeffkrol; 12-09-2012 at 09:03 AM. | |

| 12-09-2012, 09:06 AM | #18 |

|

Emphasis: For some strange reason, the Republicans are no longer bragging about the austerity movement in the UK. In case you wondered why, check it out for yourself. It’s a colossal failure and it’s getting worse. Just as many had predicted, austerity during a declining economy doesn’t fix anything. It only makes the problem worse, by cutting off critical finances and services when they’re needed the most. It’s much cheaper for governments to borrow the money and keep money moving during soft economic periods like this. Conservatives laughed off criticism of austerity, but it’s clear they were wrong. Joe Stiglitz previously compared austerity to “medieval medicine.” Paul Krugman said it was a recipe for ten more years of a depression. The IMF reported that it was costing tens of billions in the UK alone. The UK deficit has increased despite claims of the opposite and austerity already triggered a double dip in the UK. Again, outside of the right wing fantasy-land, this was all predicted from the beginning. The next time any Republican, or center-right Democrat, calls for austerity, wake them up and tell them to read the news beyond their home town or inside the Beltway. The end result of austerity is ugly, especially in these economic times, and we have plenty of examples of how destructive and costly it is. When they’re done looking at the failures in the UK, they can turn to Spain and Greece for more. The economic update in the UK is not pretty and it just gets worse. What fool would want to inflict this kind of damage in the US? Last edited by jeffkrol; 12-09-2012 at 09:40 AM. | |

| 12-09-2012, 09:11 AM | #19 |

|

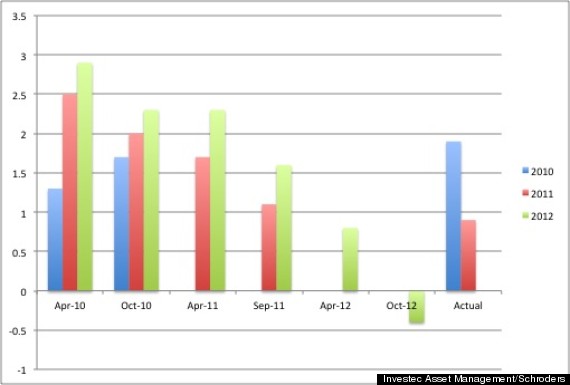

Emphasis: It’s Official: Austerity Economics Doesn’t Work It's Official: Austerity Economics Doesn't Work : The New Yorker With all the theatrics going on in Washington, you might well have missed the most important political and economic news of the week: an official confirmation from the United Kingdom that austerity policies don’t work. In making his annual Autumn Statement to the House of Commons on Wednesday, George Osborne, the Chancellor of the Exchequer, was forced to admit that his government has failed to meet a series of targets it set for itself back in June of 2010, when it slashed the budgets of various government departments by up to thirty per cent. Back then, Osborne said that his austerity policies would cut his country’s budget deficit to zero within four years, enable Britain to begin relieving itself of its public debt, and generate healthy economic growth. None of these things have happened. Britain’s deficit remains stubbornly high, its people have been suffering through a double-dip recession, and many observers now expect the country to lose its “AAA” credit rating. One of the frustrations of economics is that it is hard to carry out scientific experiments and prove things beyond reasonable doubt. But not in this case. Thanks to Osborne’s stubborn refusal to change course—“Turning back would be a disaster,” he told Parliament—what has been happening in Britain amounts to a “natural experiment” to test the efficacy of austerity economics. For the sixty-odd million inhabitants of the U.K., living through it hasn’t been a pleasant experience—no university institutional-review board would have allowed this kind of brutal human experimentation. But from a historical and scientific perspective, it is an invaluable case study. At every stage of the experiment, critics (myself included) have warned that Osborne’s austerity policies would prove self-defeating. Any decent economics textbook will tell you that, other things being equal, cutting government spending causes the economy’s overall output to fall, tax revenues to decrease, and spending on benefits to increase. Almost invariably, the end result is slower growth (or a recession) and high budget deficits. Osborne, relying on arguments about restoring the confidence of investors and businessmen that his forebears at the U.K. Treasury used during the early nineteen-thirties against Keynes, insisted (and continues to insist) otherwise, but he has been proven wrong. With Republicans in Congress still intent on pursuing a strategy similar to the failed one adopted by the Brits, this is a story that needs trumpeting. Austerity policies are self-defeating: they cripple growth and reduce tax revenues. The only way to bring down the U.S. government’s deficit in a sustainable manner, and put the nation’s finances on a firmer footing, is to keep the economy growing. Spending cuts and tax increases can also play a role, but they need to be introduced gradually. Fun w/ charts:  http://www.huffingtonpost.co.uk/2012/12/04/autumn-budget-statement-obr-imf-g...ust_reloaded=1 The inferred trend from this is even more worrying as that little one on the end is hanging upside which signifies negative growth. So, what does this all mean? Well basically, growth forecasts are almost never right. At the beginning of the year they are wildly out but by the end of the year they are more accurate. However, seeing as you have more data available and the benefit of hindsight this is to be expected. In conclusion, growth forecasts are reliable but only for a single month ahead. Which is not really much use Last edited by jeffkrol; 12-09-2012 at 09:18 AM. | |

| 12-09-2012, 09:37 AM | #20 |

| While I don't believe any of the doom and gloom about the US going bankrupt, I do think there will be large disadvantages if we try and maintain our current deficit spending levels for a long period of time (like 10-20 years). | |

| 12-09-2012, 09:51 AM | #21 |

| I agree with a lot of this, but I also think that we have to have some kind of a long term deficit reduction plan. At the moment borrowing is inexpensive because everybody wants US dollars (we are one of the most stable currencies around). If people find other safe places to put their money that provide a better return than US treasury bonds (which I expect to occur as the world recovers), the demand for treasury bonds will decrease and drive up interest rates. How I believe it works (and again, I am no economics expert), is that the US will have a choice at this point in time. We can either decrease the number of treasury bonds we are selling (driving down borrowing cost) or we can pay the higher interest rate (which will sap money out of the economy in the long term). Yes, we can inflate the currency to deal with those larger interest rates and higher levels of debt, but that will just make our treasury bonds less desirable (and per my previous assumption, further drive up interest rates). While I don't believe any of the doom and gloom about the US going bankrupt, I do think there will be large disadvantages if we try and maintain our current deficit spending levels for a long period of time (like 10-20 years). At the moment borrowing is inexpensive because everybody wants US dollars or we can pay the higher interest rate (which will sap money out of the economy in the long term) Funny little game isn't it...... Mr. Bryant cautions that the central bank may focus on buying more maturities around seven years, and less 30-year securities to "make life easier" for pension funds and insurance companies, which are traditionally big investors of long maturity If this is the case, Mr. Bryant said a good trade would be to bet that the 30-year bond will underperform next week versus shorter-dated notes. The 30-year sector also faces $13 billion in new supply next week, another factor that could weigh down on its price. The Treasury Department is also scheduled to sell $32 billion in three-year notes and $21 billion in 10-year notes, bringing in the total supply next week to $66 billion. For now, Charles Comiskey, head of Treasury trading at Bank of Nova Scotia, believes the Fed will act next week at the policy meeting, while investors closely focus on what steps U.S. lawmakers take to address the fiscal cliff. Mr. Comiskey said Treasury bonds could rally if there is no bipartisan deal by the end of December, or could fall if a budget deal is crafted. Economists have warned that allowing the fiscal tightening to take full effect could throw the U.S. economy back into a recession in 2013--a case acknowledged by the Fed and a reason that may push the central bank to launch more stimulus next week. When I started looking at our situation I had few real facts that I went in search of proof for.. so I had a lot less bias (assuming what is correct and trying to shoe horn the data to prove it) Many times people start w/ what they suspect i correct and just build support around that...err... "fact"... Or use outdated flawed models (there are many normal reasons to do this though all are risky) Not very scientific Well TECHNICALLY I went to look for reasons why we needed taxes and from where.. in order to support "social programs" such as Medicare for all.. what I found was surprising we don't....have to tax to spend.. What level of spending is good/bad/indifferent is another story.. What level of taxing good/bad/indifferent is another story.. I found most (90+ percent guesitmate) that was out there was a FALSE premise and most wrapped in an ideology.. Little raw "intelligence" sad to say.. and those that were wrapped their intelligence in ideology.. From my perspective.. this is just sad....... Am I 100% right?/ I doubt it........but at least I feel I understand the "basics" removed from emotion (which also plays a large part in our interactions) Last edited by jeffkrol; 12-09-2012 at 10:02 AM. | |

| 12-09-2012, 10:13 AM | #22 |

|

Interest on T bills is NOTHING MORE than long term stimulus for investors/ pension funds/retirees ect since we can ALWAYS pay the interest when "WE" create the dollars the interest is denominated in..... It is NOTHING more than a way to spend money into the economy Not to mention how much we are owing to ourselves.... also something of interest I want to explore.. see bold..... Domestic For the quantitative easing policy, the Federal Reserve holdings of U.S. Treasurys increased from $750 billion in 2007 to over $1.5 trillion by June 2011.[24] On September 13, 2012, in an 11-to-1 vote, the Federal Reserve announced they were also buying $45 billion in long-term Treasuries each month on top of the $40 billion a month in mortgage-backed securities. The program is called QE3 because it is the Fed's third try at quantitative easing The Fed way of sneakily relieving the banks of debt.. yet nobody ever mentions it......... on top of the $40 billion a month in mortgage-backed securities http://www.treasury.gov/resource-center/data-chart-center/Documents/Portfoli...2_11_Final.pdf Last edited by jeffkrol; 12-09-2012 at 10:19 AM. | |

|

| Bookmarks |

| Tags - Make this thread easier to find by adding keywords to it! |

gdp, highest-ever, profits, share, wages  |

Similar Threads

Similar Threads | ||||

| Thread | Thread Starter | Forum | Replies | Last Post |

| Bain & Co. Exemplar of Corporate Citizens | mikemike | General Talk | 9 | 08-08-2012 01:08 PM |

| Corporate Profits Just Hit An All-Time High, Wages Just Hit An All-Time Low Read mor | jeffkrol | General Talk | 7 | 06-26-2012 02:56 PM |

| The highest count of DSLR you ever own at any given time? | ducdao | Pentax DSLR Discussion | 32 | 08-19-2011 06:02 AM |

| Print Sells For $3.9 Million At Auction, The Highest Ever For A Photograph | jogiba | General Talk | 44 | 05-27-2011 02:44 PM |

| Pentax market share, where are you? | ismaelg | General Talk | 6 | 07-19-2010 06:35 AM |